Shariah Screening & Islamic Indices

Login to continue watching

This video is available to members only.

Shariah Screening & Islamic Indices

Duration

07m 58s

https://app.islamicmarkets.com/video/shariah-screening-islamic-indices

Shariah Screening and Islamic Indices.

The last century has seen an acceleration and

unimaginable growth in the way investments are made.

All due to the intertwining of finance technology

and better infrastructure.

Muslims have invested and traded

since the initial days of revelation.

While the Quran encourages trade and investment

and provides guidance for how muslims should

approach these activities,

formalized financial processes did not

begin to develop until the mid 20th century.

The first Shariah compliant mutual fund was

launched in Malaysia in 1979

and it was one of the world's first attempts to get

Shariah screening guidelines for such investments.

Preliminary guidelines were developed by scholars.

However this was just the beginning of the journey.

Over the last 40 years,

the Shariah screening guidelines have

continue fully developed and enhanced

as scholars continuously seek to apply

the teachings of the Quran and the Sunnah

in every facet of life in the most accurate manner.

In 1986, the famous Amanah Income Fund

was launched in the US.

This became the second Shariah compliant fund

that was launched in the world.

Despite this monumental milestone,

the Shariah guidelines for screening

are still not formerly developed.

Then in 1990, several Islamic financial institutions

from across the globe gathered to develop and

issue industry standards which gave birth to the

Accounting and Auditing Organization

for Islamic Financial Institutions,

AAOIFI.

In 2004, AAOIFI issued Shariah standard

number 21 on Financial Paper

which offered comprehensive Shariah investment

guidelines and screening criteria.

On the other hand,

Malaysia was experiencing tremendous growth

in Islamic finance and as a result

the Securities Commission Malaysia

developed early screening criteria.

In 2013, they revised their Islamic guidelines

to be more rigorous illustrating

the iterative process required

for maintaining such standards.

To identify which stocks are Islamic

the industry created new capital markets indices

to capture Shariah compliant stocks

according to different screening methodology is.

The first Islamic index introduced,

by Dow Jones in 1997 introduced

Islamic investing to a much wider audience.

Today the industry counts a handful of

Islamic Indices under Standard and Poor's

Dow Jones islamic,

FTSE

and MSCI

All of the islamic indices are composed of

two different screening stages

qualitative screening

and quantitative screening.

The first stage of qualitative screening excludes

businesses and sectors which are involved

in Shariah non compliance activities

such as conventional financial services

gambling

pork and unlawful food production.

alcohol production

tobacco dissemination etc.

These industries go against the teachings

of Islam and investing in any such area goes

against the values and visits by Islam for society.

The industry uses different references

when it comes to Shariah screening.

These are the top ones

AAOIFI

Dow Jones Islamic

FTSE Shariah

MSCI Islamic

Securities Commission Malaysia

S&P 500 Shariah

At the first stage of qualitative screening

each of these focuses on either the industry sector

or business activity of the company

to identify it's involvement in the

prohibited activities.

For some, they screen out companies have

any prohibited activity is their core business.

While others put a threshold to determine

the partial involvement of companies

in any prohibited activity

before considering them Shariah non-compliant.

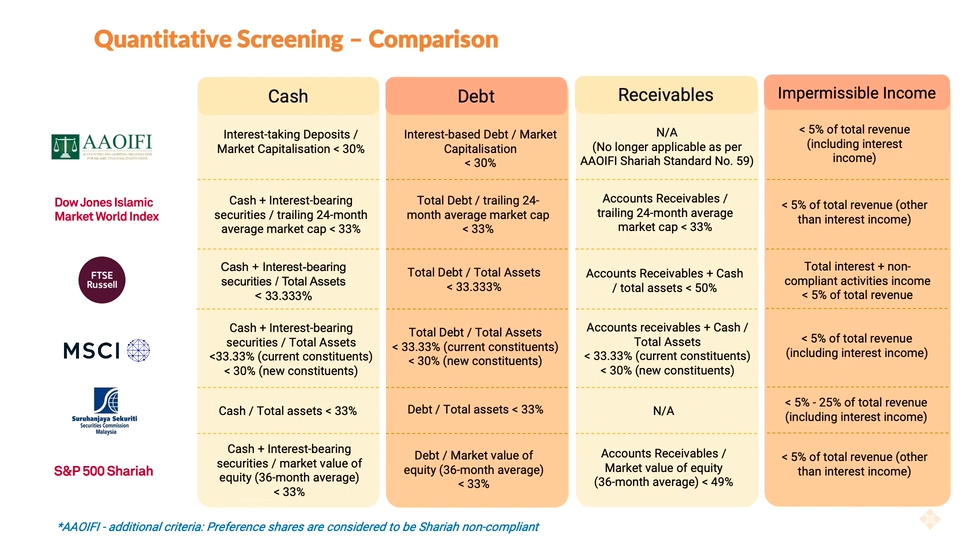

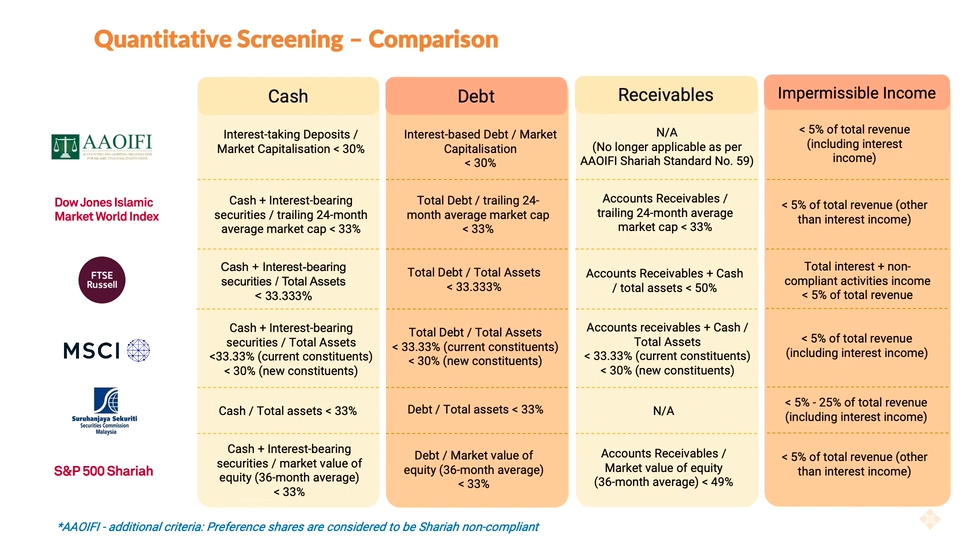

Then comes the second stage of quantitative

screening which varies among the different indices.

This screening considers the financials

of companies such as 1

cash and interest-bearing receivables

2

interest bearing debt

and 3, impermissible income.

Going back to the main references

used by the industry globally

each screening standard or Islamic Index

uses specific ratios

to determine the maximum threshold tolerated

of impure money

in the company's financials.

This is a snapshot of the different ratios used

by each index or Shariah screening standard.

Most of the indices are in consensus when

it comes to cash and interest receivables

that the maximum allowance is somewhere

between 30 and 33 per cent.

This is similar to the interest bearing

receivables in the conventional debt filter

which also ranges from 30 to 33 per cent

One goal of a Shariah compliant portfolio

is to have as little conventional debt as possible.

Islamic investment funds originally

looked for issue which was with zero debt

but that limited the universe of

investment options to severely

criteria how to develop over time

and a 33 percent debt to total assets or

total market capitalization ratio

opened up the greatest opportunity for investments

while still limiting potential downsides.

One of the main differences between

these standards and indices in the ratios used

is the denominator they use for their calculations.

Total assets vs market capitalization

Opinions on how to best evaluate company

have differed over time.

The difference comes down to whether a companies

should be evaluated based on the value of its goods

or based on the value the market is willing to pay.

When it comes to the impermissible income filter,

it varies among the indices.

The lowest tolerated figure is 5 per cent

while the highest is 25 per cent

under certain circumstances.

This commonly accepted rules stipulates that

any revenues a company receives from haram

prohibited sources

such as selling alcoholic products

must be limited to 5 per cent or

less of their total revenue.

The threshold was established in the belief

that any percentage of a business activity

above 5 per cent

changes the character of the company.

These rules have gone through many decades of

evaluation and reevaluation

and illustrates how standards are recursive

They can evolve over time while

maintaining allegiance to god's intentions

As the Islamic finance industry develops,

these standards will continue

to be reviewed and develop.

At present most Shariah screenings practice

a process of negative screening

which is the exclusion of specific industries

In fact the negative screening process

is also used among

Social and Responsible Investing Strategies (SRI).

It wasn't until 2010 that SRI began

to gain momentum among mainstream investors.

The new familiarity with SRI strategies

grew in tandem with the increase in

Environmental Social and Governance data

ESG available to investors.

When ESG data is considered alongside

financial analysis in the investment process

is known as ESG Integration.

Simultaneously SRI has evolved

to include more nuanced forms of investing

and now frequently stands for

Sustainable Responsible and Impact Investing.

If forbidding what is wrong in one's

investments is only half of one's duties,

it follows that Muslim investors should also seek to

enjoining good as the verse of the Quran states.

Just as negative screening

allows investors to exclude

impermissible activities from their portfolios,

positive screening allows asset managers to use

ESG data to identify companies with strong values

and positive social and environmental impacts.

Welcome to IslamicMarkets

A platform that connects world renowned leaders and

experts with participants in the Islamic economy.

Welcome to IslamicMarkets

A platform that connects world renowned leaders and

experts with participants in the Islamic economy.